Press Release

Report on first nine months of 2018/19: Aurubis generates operating result of € 125 million and invests in sites

Hamburg | Friday, August 9, 2019

- Maintenance shutdowns and additional expenses following halt of Future Complex Metallurgy project weigh on Q3 result

- Metallo Group acquisition a key building block in Aurubis’ consistent further development of integrated smelter network

- Aurubis continues to invest in plant availability and environmental protection at all sites

Aurubis is continuing its multi-metal strategy. The acquisition of the Belgian-Spanish Metallo Group for a purchase price of € 380 million, which is being financed without a capital increase, is an important building block in the implementation of this strategy. With its attractive growth potential, the recycling and refining company expands Aurubis’ multi-metal portfolio, especially with the metals nickel, tin, zinc, and lead. The approval of the transaction by the relevant antitrust authorities is expected by the end of the year.

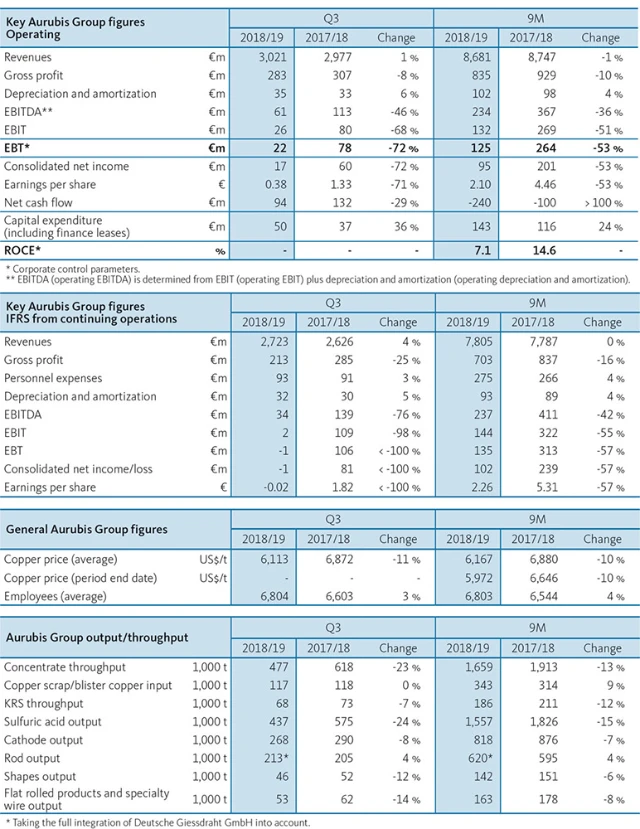

At € 8,681 million, the Aurubis Group generated revenues at prior-year level during the first nine months of fiscal year 2018/19. Operating earnings before taxes (EBT) were € 125 million (previous year: € 264 million). A significantly lower concentrate throughput, with lower treatment and refining charges at the same time, impacted the result in particular.

Unplanned shutdowns had already had a negative effect of approximately € 25 million on earnings in Q1 of the current fiscal year; a scheduled maintenance shutdown at the site in Pirdop, Bulgaria, had an additional negative effect of about € 15 million on earnings. Furthermore, expenses due to the halt of the internal investment project Future Complex Metallurgy (FCM) amounted to about € 30 million.

Other factors that led to the lower result included significantly lower refining charges for copper scrap compared to the previous year, with a good supply; higher energy costs; and weaker demand for shapes and flat rolled products.

Aurubis AG Executive Board Chairman Roland Harings remarked:

Our result in Q3 was strained by several extraordinary factors. In addition to one-time expenses from the halt of the FCM project, the operating performance of our large production units fell below expectations. The decline in demand on the product markets negatively impacted our earnings in May and June.

Operating EBT in the first nine months was supported by higher sulfuric acid revenues first and foremost. The good price level more than compensated for the lower production volumes due to the shutdowns. Sales of copper rod were also robust in the first nine months of fiscal year 2018/19.

Aurubis generated an EBT of € 135 million from continuing operations on an IFRS basis (previous year: € 313 million).* Operating return on capital employed (ROCE) was 7.1 % (previous year: 14.6 %). Operating ROCE was at half the prior-year level due to lower quarterly results, with significantly higher inventories to prepare for scheduled maintenance shutdowns at the same time.

Investment in sites, continuation of strategy

Executive Board Chairman Roland Harings affirmed: “Our multi-metal strategy remains in place. We will be able to apply some of the plans and plant configurations developed during the FCM project and use them to carry out the strategy in the future. Furthermore, the acquisition of the Belgian-Spanish Metallo Group will help Aurubis process valuable, marketable products from materials with low metal contents, thus making an important contribution to the circular economy and sustainability.”

On its ongoing path to becoming an integrated smelter network, the company will continue investing strongly in its sites in the last quarter of fiscal year 2018/19 and at the start of the new fiscal year 2019/20. After Pirdop successfully carried out legally mandated maintenance activities in its production facilities in May, additional measures are now scheduled in Lünen (25 days in September) and Hamburg (36 days in October/November). These will have an impact of about € 3 million and € 30 million on operating EBIT, respectively, but will optimize the sites’ plant availability and modernize their environmental protection. Moreover, investments were made in a new Innovation and Training Center in Hamburg, which will be officially inaugurated in early September.

Forecast for the current fiscal year, market outlook

Aurubis corrected its forecast with the publication of the half-year result and still expects operating EBT for the current fiscal year to be significantly below the previous year. Consequently, the company also anticipates a significantly lower operating ROCE compared to the previous year.

Because of shutdowns and investment measures at the sites, Aurubis expects plant availability to be lower and thus the volume of copper concentrates processed during the current fiscal year to be significantly lower than the previous year. Cathode output is also expected to be lower than the prior-year volume.

Aurubis expects satisfactory treatment and refining charges for concentrates until the end of the fiscal year. Because Aurubis is sufficiently supplied with concentrates from existing contracts for the current fiscal year, the company doesn’t have to purchase concentrates at spot market conditions, which are weaker at the moment. On the copper scrap market, too, the company continues to expect a stable supply with a good ongoing price level. The Group’s facilities are supplied at good conditions in Q4.

Aurubis anticipates weaker demand for copper rod from cable producers and considerably lower demand for copper shapes compared to the previous year. Demand for flat rolled products, especially in the European automotive sector, has been declining since fall 2018. This is expected to continue for the rest of the fiscal year. Overall, for fiscal year 2018/19, Aurubis expects the demand and sales situation to be significantly below the very good previous year.

The sales market for sulfuric acid, which is difficult to predict, recorded a significant price decrease at the end of Q3 2018/19; current information indicates that the price level will be lower in Q4 as well.

Aurubis set the copper premium at US$ 96/t for calendar year 2019 (previous year: US$ 86/t). For the most part, the Group expects to be able to implement this premium for its products.

* Because the IFRS result includes measurement effects due to metal price fluctuations and other factors, Aurubis discloses an operating result (EBT) that differs from the IFRS result. The operating result largely eliminates the effects of metal price fluctuations and thus allows for a more realistic assessment of the business performance. Operating EBT is used for control purposes within the Group.

Segment FRP will continue to be classified as discontinued operations pursuant to IFRS 5. The intended sale of the segment does not affect the operating reporting, however.

The complete Quarterly Report on the First 9 Months 2018/19 is available here.

Downloads

-

Um die heruntergeladene Komponente zu sehen den QR code scannen

Press Release as PDF

PDF

1 MB