Press Release

Nine-month report: Aurubis generates excellent result

Hamburg | Thursday, August 5, 2021

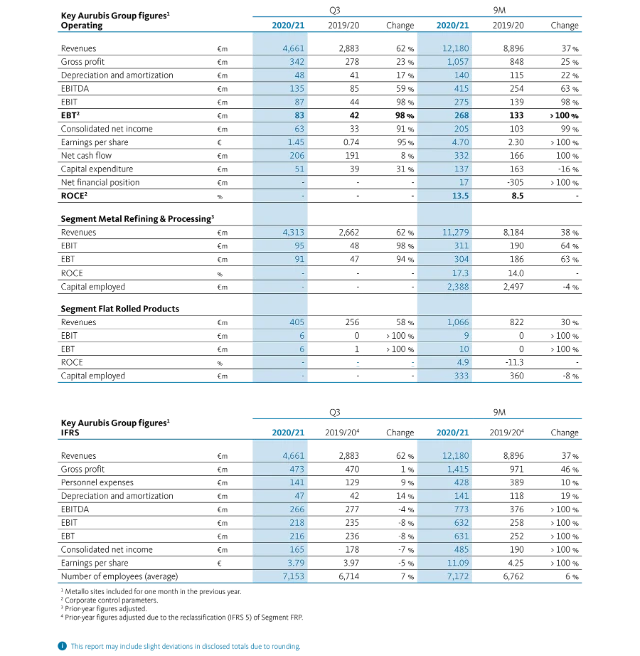

- The multimetal company generated operating EBT of € 268 million (previous year: € 133 million) in the first nine months and confirms its forecast for the current fiscal year

- Outstanding use of positive market conditions: Significantly higher refining charges, increase in throughput and production, good demand for copper products

- Impacts of production stop in Stolberg plant (NRW) due to severe weather are insignificant for consolidated result

Aurubis AG continued the positive trend of the current fiscal year in Q3, presenting more than double the result in today’s nine-month report compared to the same period of the previous year: operating EBT rose to € 268 million (previous year: € 133 million). The excellent result was mainly influenced by significantly higher refining charges for copper scrap and other recycling materials, a considerably higher throughput of other recycling materials, and a higher concentrate throughput, which was counterbalanced by lower treatment and refining charges for copper concentrates due to market factors. Higher sulfuric acid revenues also contributed to the high earnings level. With a strong increase in metal prices, the metal result was considerably higher as well.

Overall, demand for copper products remained high, and the multimetal company took optimal advantage of the good ongoing market conditions. The only negative impact on the result was the significantly higher energy costs, due especially to increased electricity prices.

Operating ROCE improved to 13.5 % owing to the good financial performance, compared to 8.5 % in the previous year. At € 332 million, net cash flow significantly exceeded the prior-year level (€ 166 million) due to the good financial performance. The IFRS EBT* of € 631 million (previous year: € 252 million) substantially exceeded the previous year as well.

Despite exceptional circumstances: Very good performance, damage in Stolberg due to severe weather not expected to impact consolidated result

Roland Harings, CEO of Aurubis AG, emphasizes that Aurubis continues its stable course during the fiscal year, a year that is once again shaped by the coronavirus crisis:

Aurubis’ development in the first nine months is extremely gratifying. Aurubis demonstrates that it is robust, even in uncertain times. We are benefiting from strong demand for our high-quality products, especially in the automotive, construction, energy, and cable industries.

Nevertheless, the Aurubis site in Stolberg, which specializes in manufacturing high-precision strip and wire made of copper and copper alloys, was affected by the severe weather in the region in mid-July. No employees were injured. However, production at Aurubis Stolberg GmbH & Co. KG had to be stopped and Aurubis had to declare force majeure.

Despite the awful situation, we’re relieved that none of the employees were injured. At Aurubis, we stand together during a crisis, and we’ll do everything to rebuild production again quickly,

, Roland Harings affirms.

The clean-up operation is in full swing with strong support. The property damage, which still has to be determined, will be covered by insurance, so we don’t anticipate any effects on our consolidated result.

Aurubis Stolberg is part of the reporting segment Flat Rolled Products (FRP). This entity accounted for approx. 2 % of consolidated revenues in the past fiscal year (2019/20) and about 2.5 % of the IFRS annual result for 2019/20.

Segment MRP: Higher output, considerable increase in recycling materials

Segment Metal Refining & Processing (MRP) generated operating EBT of € 304 million in the reporting period (previous year: € 186 million). The increase primarily resulted from the influencing factors previously mentioned. At 17.3 % (previous year: 14.0 %), ROCE considerably exceeded the 15 % target.

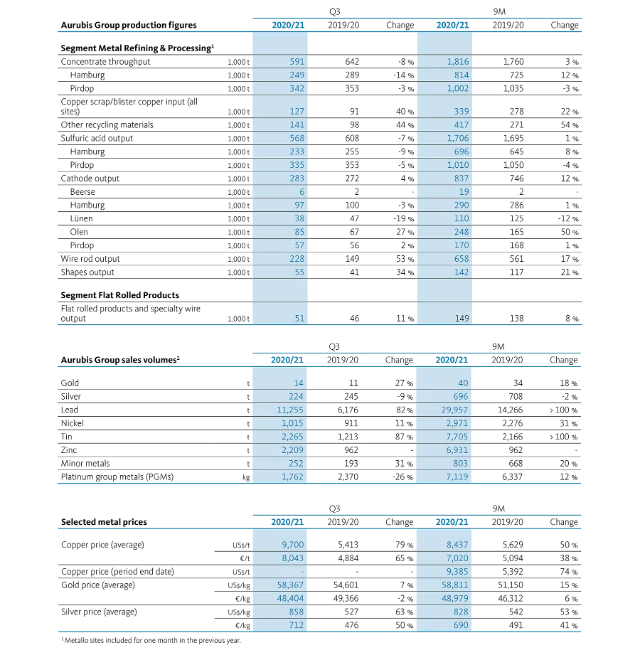

The concentrate throughput of 1,816,000 t after the first nine months of the current fiscal year exceeded the previous year (1,760,000 t). In addition to the planned shutdown of the anode furnace in Hamburg, smaller repair shutdowns affected throughput in Q3. Cathode output increased by 12 % compared to the previous year, to 837,000 t (previous year: 746,000 t). The previous year was negatively impacted by crane damage in the tankhouse in Olen. In Q3 2020/21, cathode output at the Lünen site was down significantly on the previous year again as a result of the ongoing modernization measures in the tankhouse.

The substantial increase in copper scrap/blister copper (up 22 %) and other recycling materials (up 54 %) compared to the previous year is mainly due to the inclusion of the Beerse (Belgium) and Berango (Spain) sites. This led to higher revenues from refining charges as well as higher metal sales volumes, especially for tin, zinc, nickel, and lead.

Markets: Positive trend in recycling, high demand for sulfuric acid, stable demand for cathodes and copper products

The very positive trend in the copper scrap and recycling markets continued in Q3 of the fiscal year. High metal prices, particularly the continued increase in the copper price, supported the supply of copper scrap and other recycling materials in Europe and the US, with rising refining charges. Aurubis utilized the good market situation and was able to supply its production facilities with input materials at very good refining charges during the past quarter.

After a strong demand recovery in the first half of 2020/21, the global sulfuric acid market experienced high demand with a tightening supply in Q3 2020/21 as well. This led to a tremendous increase in prices on all spot markets during the reporting period.

The cathode market recorded stable demand overall in the sales markets relevant to Aurubis in Q3 2020/21. At US$ 96/t, the Aurubis Copper Premium for calendar year 2021 is the same as in the previous year.

Demand for copper wire rod remained at a high level in the reporting period following a positive trend. Demand from the cable, construction, energy, and European automotive industries stayed stable in Q3 2020/21. Likewise, the positive trend for high-purity shapes continued. The order situation considerably exceeded the prior-year level until the end of June.

Segment FRP: Improved result due to high product demand and strict cost management

Segment Flat Rolled Products (FRP) generated operating earnings before taxes (EBT) of € 10 million in the first nine months (previous year: € 0 million). The substantial improvement in results compared to the previous year was caused by a significantly higher sales volume with stable costs due to strict cost management, as well as very good copper scrap availability.

Output of flat rolled products and specialty wire increased to 149,000 t due to demand (previous year: 138,000 t). Operating ROCE (taking the operating EBIT of the last four quarters into consideration) was 4.9 % (previous year: -11.3 %) due to higher operating earnings contributions. The previous year included the negative one-off effects of € 51 million reported in Q4 2018/19. Aurubis still stands by its intention to sell Segment FRP and is in advanced contract negotiations.

Implementing projects – on the path to even more sustainability and lower CO2 emissions

Important projects that will contribute to the achievement of Aurubis’ climate targets were initiated in Q3: in May, a series of tests started for hydrogen use on an industrial scale in copper anode production at the Hamburg plant. In the pilot project, hydrogen and nitrogen were introduced in the production facility (anode furnace) instead of natural gas. Initially, the current tests will gauge the reaction of the facility to the introduction of hydrogen and ensure that the individual production steps, which are highly sensitive in the energy-intensive metal production process, run smoothly. “In the medium term, hydrogen could replace fossil fuels in the production process. Due to hydrogen’s high reactivity, Aurubis expects enhanced efficiency in the production process as well,” Roland Harings states.

An additional milestone was achieved by Aurubis Bulgaria in June with the construction kick-off of a 10 MW photovoltaic (PV) plant in Pirdop. After its completion, it will be Bulgaria’s largest PV plant for internal electricity production in a company. The site’s goal is to cover about 20 % of its energy needs from its own renewable sources by 2030.

In June, the Science Based Targets initiative (SBTi) validated Aurubis AG’s CO2 reduction targets, thus confirming that the multimetal company’s targets contribute to limiting global warming to 1.5°C pursuant to the Paris climate agreement. CEO Roland Harings explains: “We have set out to reduce CO2 emissions generated by burning fuels in internal facilities and those related to purchased energy by 50 % until 2030 – compared to the base year 2018. We want to reduce the emissions that arise in the upstream and downstream stages of the value chain by 24 % during the same period as well.”

Aurubis has already substantially reduced the CO2 footprint of its copper cathodes with the measures implemented in the past several years: the latest calculations from their life cycle assessment showed that only 1,690 kg of CO2 are emitted per ton of copper – that’s more than 50 % below the global level, according to a study from the ICA (International Copper Association).

ASPA: Innovation in recycling, synergies with new sites

In late July, Aurubis announced the planned construction of another state-of-the-art recycling facility in Beerse (Belgium). With the new hydrometallurgical facility ASPA (Advanced Sludge Processing by Aurubis), the company is strengthening its core business and taking the next step in becoming the most efficient and sustainable smelter network in the world. In the coming years, investments of € 27 million are planned for this. The new facility will process anode sludge, a valuable intermediate product of the copper tankhouse, from the recycling sites in Beerse and Lünen. ASPA is a very good example of the synergies that have come to life through the integration of the new Beerse and Berango sites in the Aurubis production network.

Positive outlook: Influence of the coronavirus crisis very low, confirmation of this year’s forecast; Capital Market Day in December

Aurubis has made its way through the coronavirus crisis very robust so far. The company assesses the effects on the rest of the fiscal year, which ends on September 30, as very low. Because of the steep increase in CO2 prices, the company nevertheless expects significantly higher electricity costs for the fiscal year compared to the previous year. At the same time, Aurubis anticipates a continued improvement in earnings from the Performance Improvement Program (PIP) through cost reductions.

In fiscal year 2020/21, Aurubis will already achieve the goal (previously set for 2022/23) of generating synergies of € 15 million (EBITDA) from the integration of the acquired Beerse and Berango sites. Overall, an operating EBT between € 270 and 330 million and an operating ROCE between 9 and 12 % are expected for the Aurubis Group in fiscal year 2020/21.

As already announced, Aurubis is reviewing its current corporate strategy in a multi-stage process; the company will present detailed information and concrete measures at its Capital Market Day on December 6/7, 2021.

* Because the IFRS result includes measurement effects due to metal price fluctuations and other factors, Aurubis discloses an operating result (EBT) that differs from the IFRS result. The operating result largely eliminates the effects of metal price fluctuations and thus allows for a more realistic assessment of the business performance. Operating EBT is used for control purposes within the Group.

At a Glance

Downloads

-

Um die heruntergeladene Komponente zu sehen den QR code scannen

Press Release as PDF

PDF

1 MB